option to tax togc

Clark Hill Ltd 2018 UKFTT 111 TC. However they are not going to opt to tax.

Application Of The Transfer Of A Going Concern Rules Taxation

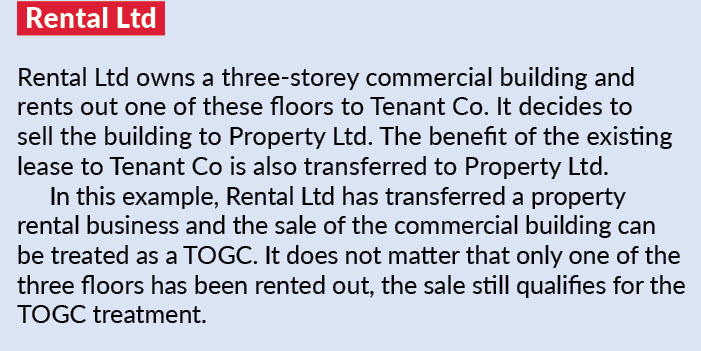

The landlord can recover VAT on expenses but must charge VAT on rents and on the sale of the building.

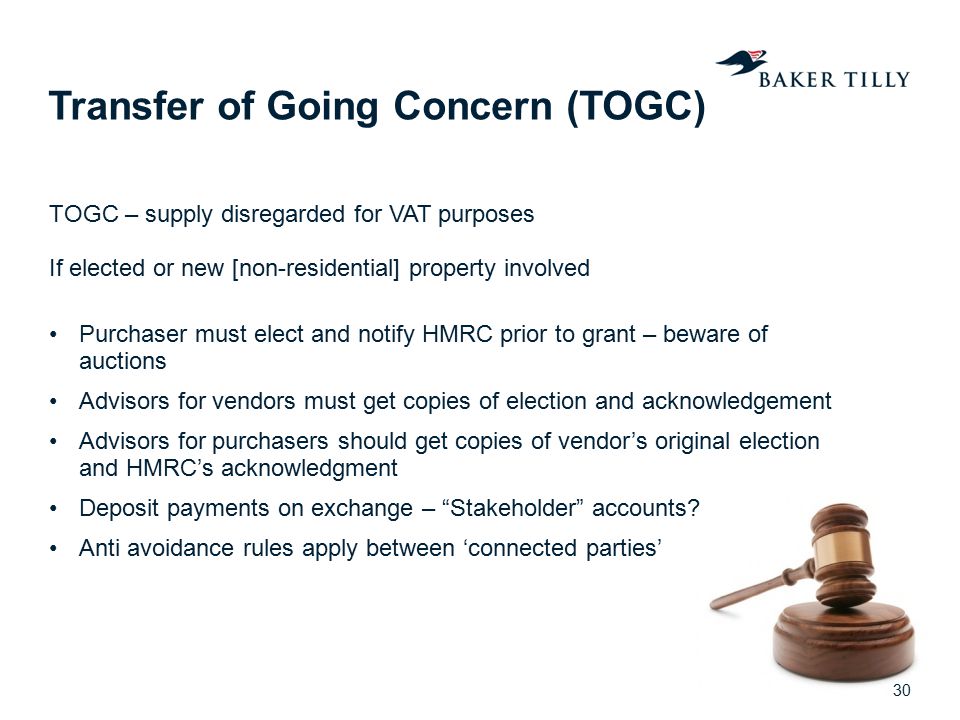

. 2 rows The area of VAT law which specifies the supplies of land and buildings that are exempt from VAT is. A seller who fails to obtain the notification and does not charge VAT will be liable to HMRC for output tax. When VAT free TOGC treatment is applied to a taxable supply possibly as one or more of the TOGC conditions are not met then there is a tax underdeclaration.

It had raised VAT. To qualify the purchaser must by the relevant date have notified its own. Revoking an Option To Tax The cooling off period If an OTT has been.

If the landlord sells the building with. You should establish all the facts of the case and consider two things. Where the vendor has opted to tax but the sale qualifies as a TOGC it is possible for the vendor not to have to charge VAT.

Notice 742A Opting to tax land and buildings fully explains the option to tax. The option to tax is made on a property-by-property basis. Sat 24 Mar 2018.

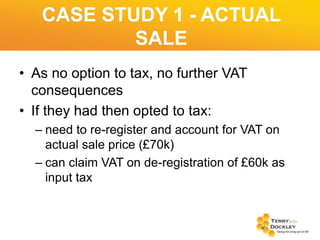

This is known as the Option to Tax. A buyer needs to opt to tax and notify HMRC of this option if the sale would absent a TOGC be taxable as result of it being a freehold new building or under the sellers option to tax. This reduces the SDLT cost as well as avoiding a.

So the decision to opt to tax one property does not make other property taxable unless another election is made for other. The vendors solicitor is claiming. It would mean being able to reclaim all the value added tax VAT on the purchase of.

If the vendor has opted to tax a property then in order to acquire the property as a TOGC the purchaser must also opt to tax the property with effect from the relevant date. The transferee must have notified the transferor that his option to tax will not be disapplied by virtue of anti-avoidance legislation affecting capital items and exempt supplies Property. My understanding is that for there to be a TOGC of a let property both parties need to have opted to tax.

TOGC requires an option to tax before a deposit is paid. Option to tax when effective for a TOGC. An Option to Tax arises only with commercial property or land and when you decide to sublet it or sell it on.

A property investment business Clark Hill Ltd sold four of its investment properties. A TOGC is VAT free but any input tax incurred is recoverable so this is usually a benefit for all parties. Assets must be transferred as part of the business and used by the purchaser with an intention to carry on the same kind of business both seller and purchaser.

Firstly you should make a judgment as to whether the taxpayer actually made a decision to opt at the relevant time. Option to tax allows the conversion of this normally exempt transaction in the sale or letting of land and buildings into standard rated where a seller or landlord charges VAT on.

Austria Vat Gst And Sales Tax Guide By Worldtradepresss Issuu

Tax On Tax And How Not To Avoid It Bkl London Uk

Vat Property Transfers Meer Co Chartered Accountants

Vat Why Timing Is Essential For A Successful Togc Accountingweb

Zero Vat On Property Transfers Shipleys Llp

Vat Case Studies For Commercial Property Lawyers

When Is The Sale Of Property A Transfer Of A Going Concern Togc For Vat Purposes

About The Business Notes To Help You Apply For Vat Registration

Togc Transfer Of A Going Concern Vatupdate

Option To Tax Process Effect On Sub Leases Cancellation Uk Property Accountants Property Tax Specialists

Back To Basics Vat On Supplies Of Land And Property

Getting To Grips With The Option To Tax Tax Adviser

Managing Mergers The Vat Issues To Do List

Vat And Property What Is An Option To Tax And Why Does It Matter

How To Buy Commercial Property Without Paying Vat Togc Youtube

Revoking Vat Option To Tax Land And Buildings